Whatever you’re considering investing in, Stop-Loss and Take Profit orders are among the best ways to manage your open positions and your exit strategy. They form the cornerstone of an effective risk management strategy and can help you to optimise your returns.

Discover what Stop-Loss and Take-Profit orders are and how they can help to minimise risk. Learn about setting Stop-Loss targets and how to develop your own risk ratio.

Stop-Loss and Take-Profit orders allow you to manage trading positions without having to constantly watch the markets. They also help you to limit your losses and lock in gains. Learning how they work, and how to get the most out of them, can make your trading experience more user-friendly and help your overall investment strategy.

What are Stop-Loss and Take-Profit orders?

Stop-Loss and Take-Profit orders are trading features that instruct your broker to automatically reduce the size of a position if the price of an asset reaches a certain level.

A Stop-Loss order is used as a risk management tool. If a position you are holding falls to a predetermined level, some, or all, of your position will be closed. This caps your losses at an amount you are comfortable with, while protecting capital.

On the other hand, Take-Profit orders are primarily about protecting gains. When a winning position reaches a target price, a percentage of it will be closed. This converts unrealised profit into realised profit, without investors needing to actively monitor the market.

How can Stop-Loss strategies help to minimise risk?

Stop-Losses can instil an additional degree of discipline into trading behaviour and help to avoid emotional investing by encouraging investors to identify clear entry and exit points. This helps to build an effective framework for the lifecycle of a trade, increasing focus on returns.

As Stop-Loss and Take-Profit orders are triggered automatically, investors will be less tempted to micromanage their portfolios and will be less likely to miss opportunities because of distractions. These orders should also, in theory, help to avoid making rushed decisions based on short-term price fluctuations.

How to set Stop-Loss targets

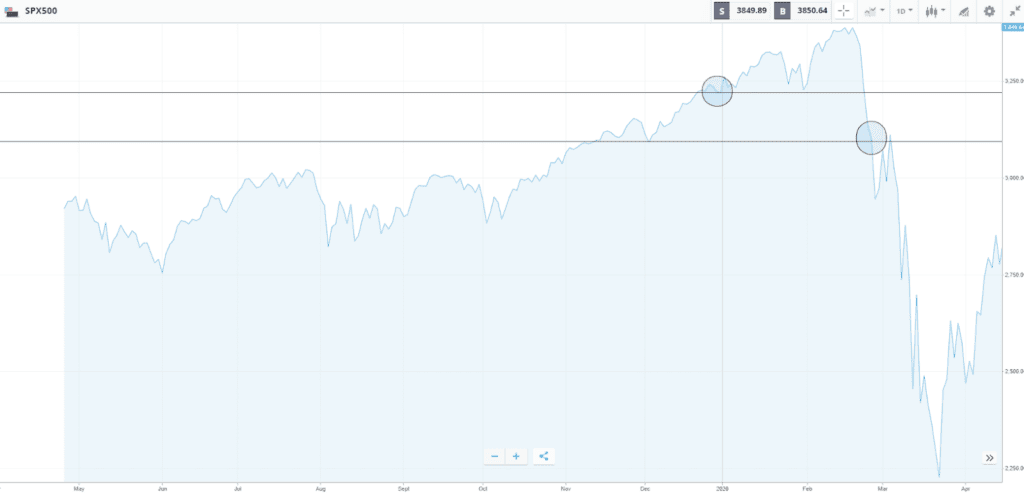

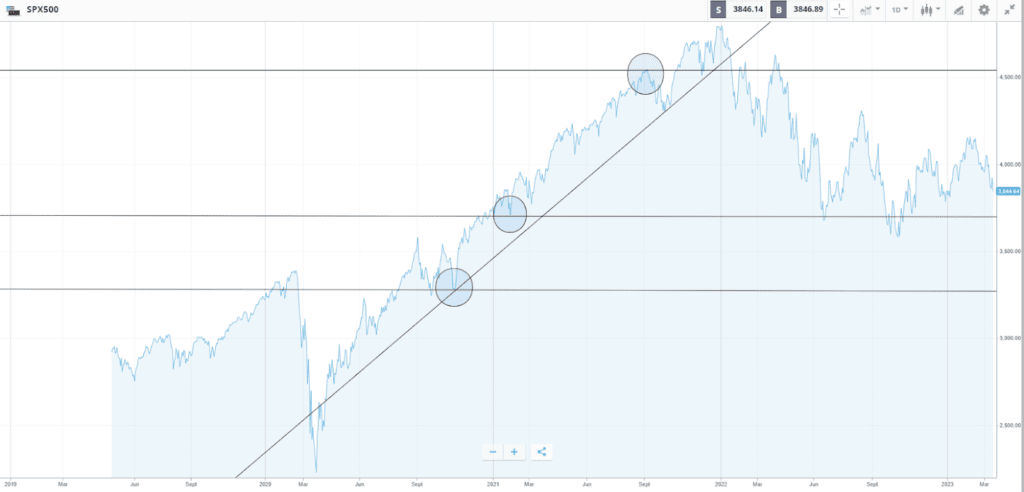

The level at which you set your Stop-Loss order should be based on how much you are willing to lose on a trade. This will, in turn, be influenced by your risk profile. For example, some investors will want to cap their losses at 10% and would, therefore, set their Stop Losses accordingly. Alternatively, technical analysis indicators might suggest important support and resistance price levels for investors to use as a guide.

For illustration purposes only. Past performance is not an indication of future results

Source: eToro

How do Take-Profit strategies work?

Take-Profit strategies help to ensure profitable trades keep posting returns. Banking profits is often a good idea, and having predetermined exit points helps to ensure that you’re not influenced by your emotions when prices fluctuate.

As with Stop-Losses, Take-Profit orders can be set at levels from which they post a percentage, or monetary, value gain. Technical indicators, such as Fibonacci retracement levels and moving averages, offer clues as to where a successful price move might start to lose momentum and possibly reverse.

For illustration purposes only. Past performance is not an indication of future results

Source: eToro

Setting your own risk ratio

To work out your risk ratio, divide your target net profit by the amount of capital you are willing to risk. In terms of the features mentioned above, this would be the total cash gain from a triggered Take- Profit, divided by the total loss seen if your Stop-Loss is activated.

Many investors won’t consider risk-reward profiles of less than 2:1 — risking $1 to win $2, for example. Although this may seem conservative, it encourages a more disciplined approach that allows you to figure out your plan for riding out market volatility.

To use the example above, if you wanted to invest $500 and had a risk-reward profile of 2:1, you could consider setting your Take-Profit at $1,000 and your Stop-Loss at $250. If the Take-Profit was triggered, you would have $500 in realised profit. If your Stop-Loss was activated, however, the value of your position would be $250 less than when you opened it.

Final thoughts

Stop-Loss or Take-Profit orders are particularly popular in short-term strategies. It moves the focus away from the process of trading, instead helping them to focus on making returns and the reasons for investing. In addition, Stop-Losses and Take-Profits are also a good potential option for investors who don’t want to monitor their portfolio’s every move. Remember, you decide the price levels at which to set your Stop-Loss and Take-Profit orders, and they can be adjusted at any time.

Visit the eToro Academy to find out more about how using Stop-Losses and Take-Profits can optimise your returns.

![[MỚI NHẤT] Tỷ giá tiền tệ Trung Quốc hiện nay và kinh nghiệm đổi tiền chi tiết](/uploads/blog/2024/09/30/728274821d507636e232df1013fc14037ed64a49-1727664247.png)

![Danh sách các ngân hàng tại Việt Nam [Cập nhật mới nhất]](/uploads/blog/2024/09/30/917dce39affb87f198fc760c1dc30e68f2341bc5-1727662578.jpg)